Create a Monthly Budget That Actually Works :A well-crafted budget is the cornerstone of financial stability. It’s a roadmap that guides your spending, saving, and investing decisions. While creating a budget might seem daunting, it’s a simple process that can significantly impact your financial future.

Understanding the Basics of Budgeting

What is a Budget? A budget is a financial plan that outlines your expected income and expenses over a specific period. It helps you track your spending habits, identify areas where you can cut back, and allocate funds for your financial goals.

Why is Budgeting Important?

- Financial Control: A budget empowers you to take control of your finances.

- Goal Setting: It helps you set and achieve financial goals, whether it’s saving for a vacation, buying a house, or retiring early.

- Debt Reduction: A budget can help you prioritize debt repayment and reduce your overall debt burden.

- Emergency Fund: Budgeting allows you to allocate funds for an emergency fund, providing a safety net for unexpected expenses.

- Mindful Spending: By tracking your expenses, you become more mindful of your spending habits and can identify areas for improvement.

Steps to Create a Monthly Budget

1. Track Your Income:

- Identify Income Sources: List all sources of income, including your salary, rental income, or any other earnings.

- Calculate Net Income: Subtract taxes, insurance premiums, and other deductions from your gross income to determine your net income.

2. Categorize Your Expenses:

- Fixed Expenses: These are regular expenses that remain relatively constant, such as rent, mortgage payments, utility bills, and insurance premiums.

- Variable Expenses: These are expenses that fluctuate from month to month, including groceries, dining out, entertainment, and transportation costs.

- Debt Payments: Include any debt payments, such as credit card bills, student loans, or car loans.

3. Set Financial Goals:

- Short-Term Goals: These are goals that can be achieved within a year, such as saving for a vacation or a new appliance.

- Long-Term Goals: These are goals that take several years to achieve, such as buying a house, starting a business, or retiring early.

4. Allocate Funds:

- Prioritize Needs: Allocate funds to essential expenses like housing, utilities, and groceries.

- Fund Your Goals: Set aside a portion of your income for your short-term and long-term goals.

- Create an Emergency Fund: Aim to save at least three to six months’ worth of living expenses.

- Allow for Flexibility: Allocate a small amount for unexpected expenses or discretionary spending.

5. Track Your Spending:

- Use Budgeting Apps: Utilize budgeting apps to track your spending and income.

- Review Your Spending Regularly: Review your spending habits periodically to identify areas where you can cut back.

- Adjust Your Budget as Needed: Be flexible and adjust your budget as your income and expenses change.

Tips for Successful Budgeting

- Start Small: Begin with a simple budget and gradually add more details as you become comfortable.

- Be Realistic: Set realistic goals and expectations for your spending and saving.

- Automate Savings: Set up automatic transfers to your savings and investment accounts.

- Review and Adjust: Regularly review your budget and make adjustments as needed.

- Celebrate Milestones: Reward yourself for achieving your financial goals.

- Seek Professional Advice: If you need help creating or managing your budget, consult with a financial advisor.

Common Budgeting Mistakes to Avoid

- Underestimating Expenses: Be honest about your spending habits and allocate enough funds for each category.

- Overspending: Avoid impulse purchases and stick to your budget.

- Ignoring Debt: Prioritize debt repayment and allocate funds to reduce your debt burden.

- Not Tracking Spending: Tracking your spending is crucial for identifying areas where you can cut back.

- Not Adjusting Your Budget: Regularly review and adjust your budget to accommodate changes in your income and expenses.

By following these steps and avoiding common pitfalls, you can create a monthly budget that works for you. Remember, budgeting is a journey, not a destination. Stay committed, be patient, and celebrate your financial successes along the way.

Conclusion

Creating and maintaining a monthly budget is a powerful tool for achieving financial freedom. By understanding your income, tracking your expenses, and setting realistic financial goals, you can take control of your finances and build a brighter future.

Remember, budgeting is a journey, not a destination. It’s important to be patient, flexible, and consistent. By reviewing and adjusting your budget regularly, you can ensure that it continues to work for you.

Frequently Asked Questions (FAQ) About Budgeting

General Questions

- Why is budgeting important? Budgeting is crucial for financial stability and goal achievement. It helps you track your income and expenses, identify areas for savings, and make informed financial decisions.

- How often should I review my budget? It’s recommended to review your budget at least once a month. However, if your financial situation changes significantly, you may need to adjust your budget more frequently.

- Can I use a budgeting app to track my expenses? Yes, budgeting apps can be a great tool for tracking your expenses. They often offer features like expense categorization, budgeting tools, and financial reports.

Budgeting Tips

- How can I stay motivated to stick to my budget? Celebrate small victories, set realistic goals, and reward yourself for achieving them. Also, find a budgeting method that works for you, whether it’s a simple spreadsheet or a sophisticated budgeting app.

- What if I overspend one month? Don’t beat yourself up. Learn from your mistakes and adjust your budget for the next month.

- How can I save money on a tight budget? Consider cutting back on non-essential expenses, such as dining out or entertainment. Look for ways to reduce your monthly bills, like negotiating with your cable or internet provider.

Budgeting Strategies

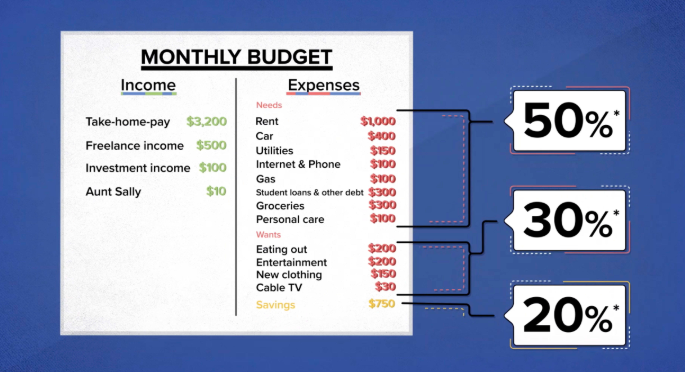

- What is the 50/30/20 budget rule? The 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- What is the envelope system? The envelope system involves allocating cash to specific categories and placing it in envelopes. Once the money is gone, you can’t spend it.

- What is zero-based budgeting? Zero-based budgeting involves allocating every dollar of your income to a specific expense category.