A good credit score is essential for various financial endeavors, from securing loans to renting an apartment. If you’re looking to boost your credit score quickly, here are some practical strategies:

Understanding Your Credit Score

Before diving into improvement strategies, it’s crucial to understand what factors influence your credit score. The primary factors are:

- Payment History: Timely payments are the most significant factor.

- Credit Utilization Ratio: This is the amount of credit you’ve used compared to your total credit limit.

- Length of Credit History: A longer credit history generally indicates financial responsibility.

- Credit Mix: Having a mix of credit types (credit cards, loans) can positively impact your score.

- New Credit: Frequent applications for new credit can temporarily lower your score.

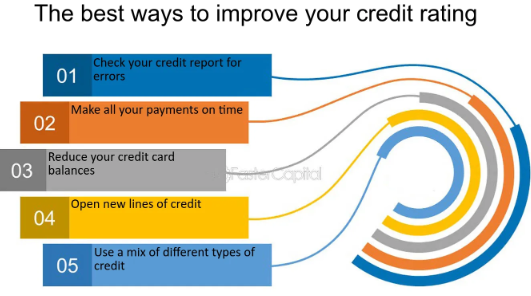

Proven Strategies to Improve Your Credit Score

1. Pay Your Bills on Time, Every Time

- Set Reminders: Use digital calendars or phone apps to set reminders for due dates.

- Automate Payments: Set up automatic payments to avoid late fees and missed payments.

2. Lower Your Credit Utilization Ratio

- Pay Down Balances: Reduce the amount of debt you owe on credit cards.

- Avoid Maxing Out Cards: Keep your credit usage below 30% of your credit limit.

3. Don’t Close Old Accounts

- Maintain a Good Credit History: Older accounts contribute positively to your credit score.

- Consider Closing Unused Accounts: If you have unused accounts, consider closing them to simplify your financial life.

4. Limit New Credit Applications

- Avoid Multiple Applications: Each application can temporarily lower your score.

- Shop Around Wisely: If you need to apply for new credit, do it within a short period to minimize the impact on your score.

5. Dispute Errors on Your Credit Report

- Review Your Report Regularly: Check for inaccuracies and errors.

- Dispute Errors Promptly: Contact the credit bureaus and the creditor to correct any mistakes.

6. Consider a Credit Builder Loan

- Responsible Borrowing: These loans can help you establish a positive payment history.

- Small, Manageable Payments: Make consistent, on-time payments to improve your credit score.

7. Use a Credit Monitoring Service

- Stay Informed: Monitor your credit report for any changes or suspicious activity.

- Early Detection of Issues: Quickly identify and address any potential problems.

Additional Tips for Faster Credit Improvement:

- Pay More Than the Minimum Payment: Paying more than the minimum payment can help reduce your balance faster.

- Avoid High-Interest Debt: Prioritize paying off high-interest debt to save money and improve your credit score.

- Be Patient: Improving your credit score takes time. Don’t get discouraged by slow progress.

- Seek Professional Advice: If you need personalized guidance, consult with a credit counselor or financial advisor.

Common Mistakes to Avoid

- Closing Too Many Accounts: Closing too many accounts can shorten your credit history.

- Ignoring Debt: Ignoring debt can lead to collection actions, which can severely damage your credit score.

- Opening Too Many New Accounts: Multiple new accounts can negatively impact your credit score.

- Not Reviewing Your Credit Report: Regular review of your credit report can help you identify and correct errors.

Conclusion

By implementing these strategies and avoiding common mistakes, you can significantly improve your credit score and unlock a world of financial opportunities. Remember, consistency is key, so stay committed to your financial goals.

Improving your credit score takes time and effort, but it’s a worthwhile endeavor. By understanding the factors that influence your credit score and implementing the strategies outlined in this guide, you can 1 significantly boost your financial health.

Frequently Asked Questions (FAQ) About Improving Your Credit Score

General Questions

- What is a good credit score? A good credit score typically ranges from 700 to 750. However, a score above 750 is considered excellent.

- How long does it take to improve a credit score? The time it takes to improve your credit score varies depending on your starting point and the strategies you implement. Consistent positive financial behavior can lead to noticeable improvements within a few months.

- Can I improve my credit score without a credit card? Yes, you can improve your credit score without a credit card. Consider alternative options like secured loans or credit builder loans.

Specific Strategies

- How can I dispute errors on my credit report? You can dispute errors by contacting the credit bureaus directly or by using a free online dispute service. Be sure to provide documentation to support your claim.

- What is a credit utilization ratio, and how can I lower it? Your credit utilization ratio is the amount of credit you’ve used compared to your total credit limit. To lower it, pay down your credit card balances and avoid maxing out your cards.

- How can I avoid identity theft, which can negatively impact my credit score? Protect your personal information, monitor your credit reports regularly, and consider using a credit monitoring service.

Additional Tips

- Be Patient: Improving your credit score takes time and consistent effort.

- Seek Professional Help: If you’re struggling with debt or credit issues, consider consulting with a credit counselor or financial advisor.

- Stay Informed: Stay up-to-date on the latest credit laws and regulations.